ABCS: US Small-Mid Cap Dynamic ETF

Value-Focused & Centered

Quality & Growth

Fundamental Bottom-up Security Selection

Disciplined Repeatable Process

Disciplined Risk Management

Broad Diversification

“Investing as Easy as ABC”™️

Value, Fundamentals, Quality, Momentum (V,F,Q,M)

Investment Objective of ABCS

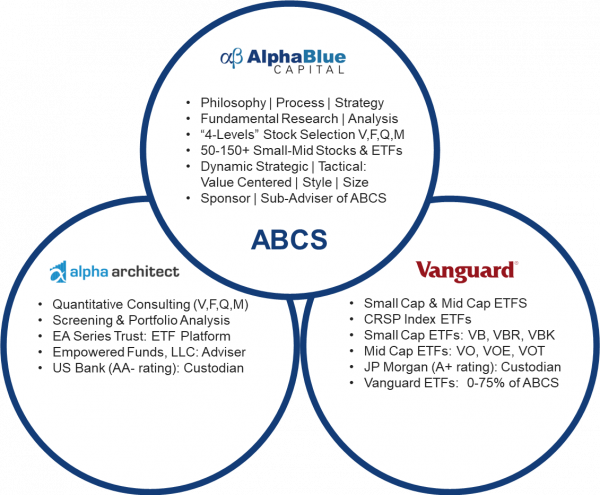

ABCS ETF Three Circles Investment Overview & Strategy

ABCS is a pioneering Dynamic Active Equity ETF that invests in a multi-factor portfolio of Small & Mid Cap individual stocks with attractive Valuation, sound Fundamentals, Quality & positive business Momentum (V,F,Q,M) characteristics with the flexibility to integrate Vanguard Small & Mid Cap passive CRSP equity index ETFs focusing on the less efficient, bottom 30% of stocks by market weight of the US stock market.

ABCS’s portfolio of Small & Mid Cap Individual stocks represents 25%-100% portfolio weighting of the total 50-150 holdings and Small & Mid Cap passive equity index ETFs range from 0%-75% weighting with 0-6 holdings. At launch, ABCS held 100 stocks and 4 Vanguard Small & Mid Cap passive CRSP index ETFs representing approximately a 65% and 35% weighting in the portfolio, respectively.

The investment objective of ABCS is long term capital appreciation with targeted annualized alpha1& investment performance of 1%-3% in excess of broad Small and/or Mid Cap Index ETF returns over a full market cycle with the opportunity to outperform the Larger Cap broader US market’s returns. A summary of key overall Portfolio targets and guidelines are as follows:

- Total number of Stocks: 50-150

- Weight of Stock Portfolio: 25%-100%

- Maximum Weight of a Stock: 5%

- Total number of Vanguard ETFs: 0-6

- Weight of ETF Holdings: 0%-75%

- Maximum Weight of an ETF: 25%

- Benchmark: Bloomberg US 2500 (Small-Mid) Index

- Annualized Alpha: 1%-3% over full market cycle

- Annual Portfolio Turnover: 10%-40%

- Active Share: 50%-80%

- Standard Deviation of Returns: In line with broad Small and/or Mid Cap Index ETFs

Investment Philosophy – Four Tenets

“4-levels” of Bottom-up Stock Selection Discipline (V,F,Q,M)

Level 1 – Valuation: Traditional Valuation Measures, Enterprise Value2 Valuation Measures, Peer & Market Comparisons, Intrinsic Valuation | Margin of Safety & Other Value-Focused Measures taking into account Growth & Profitability Attributes.

Level 2 -Fundamentals & Quality | Wide-Narrow Moat: Strategy & Competitive Position, Profitability, Growth, Intangibles, Financial & Balance Sheet Strength, ESG and other Fundamental Analysis considerations to evaluate overall Quality | Assess long to short term prospects for sustained competitive advantage.

Level 3 – Business Momentum & Catalysts| Momentum : Business Improvement through increased revenue, earnings & other measures of improving operating performance while meeting or exceeding expectations. And/or positive stock specific Catalysts that may lead to Business & Price Momentum and outperformance versus the market. Consider potential Price Momentum Velocity probabilities along with % upside to Target Price.

Level 4 – Target Price | Risk & Conviction | Weighting in Benchmark: Determine Target Price: Base Case % Upside and estimate Best & Bear Case Targets. Assess stock specific weight within the Benchmark and consider the position size degree of overweight or underweight active share based on given specific risks & conviction probabilities.

Risk Assessment & Management

- Business Risk – External/Operational Threats that may prevent a company from achieving its goals.

- Financial Risk – Not being able to meet financial obligations including credit risk and loss of profits.

- Valuation Risk – Uncertainty of the Value of investment both in variability and magnitude.

- Earnings Risk – Uncertainty of Earnings expectations being met both in variability and magnitude.

- Liquidity Risk – How easily a security can be bought or sold in the market and converted to cash.

- Volatility Risk – Volatility of the price of a security as a result of a change in an investment/risk factor.

Active Equity 6-Step Investment Process

Step 1: Internal & External Investment Universe Screening on Value, Fundamentals, Quality, Momentum Factors (V,F,Q,M) & Other Criteria

Step 2: Fundamental Analysis & Investment Research (Internal & External) through the “4-Levels” Framework.

Step 3: Define Target Price | Intrinsic Value with Sell Discipline related to success in achieving Target Price or weakening or reversal of any of the “4-Levels” resulting in a Hold|Trim|Sell Decision.

Step 4: Individual Stock Position Sizing & Portfolio Construction based on % Upside to Target Price, Valuation, Quality & Growth, Momentum, Risk Assessment, Conviction, Active Share and Liquidity resulting in ongoing Buy|Add|Hold|Trim|Sell Decisions.

Step 5: Portfolio Monitoring & Management of Individual Securities & Maintain Favorable Total Portfolio Characteristics.

Step 6: Disciplined Risk Management through the “4-Levels” of Stock Selection, Assessment of Stock Specific Risks, Diversification Guidelines, Individual Stock Position Sizing and Sell Discipline.

ABCS Investment Considerations & Applications

We believe ABCS is ideal for taxable and tax-exempt individual investor accounts and ultimately for Family Offices and Institutional Investors as AUM grows that would benefit from greater exposure to the bottom 30% of the US Market by market weight from a diversification and enhanced investment return opportunity. Some Investment applications of ABCS-Alpha Blue Capital US Small-Mid Cap Dynamic ETF are as follows:

- Stand Alone basis for Active/Passive US Small-Mid Cap exposure.

- Part of a US Small-Mid Cap Multi Manager mandate (Active and/or Passive)

- Passive Equity Investors in the S&P 5003 and/ or Total US Market

- US Large Cap biased Active and/or Active/Passive Investors

- Private Equity and/or Private Business Owners.

- Part of a Global Equity Mandate

ABCS’s Investment Universe Screening & Fundamental Analysis

The Investment Management industry standard Bloomberg Professional Services is a very important tool to the Investment Process for information, analysis, monitoring and managing the portfolio. Morningstar Direct also has an important portfolio management, analysis & attribution role. Bloomberg US 2500 & US 500 Benchmark/Indexes are provided and licensed from Bloomberg Index Services Limited. They provide an excellent quality, single source for all investment market benchmarks and are highly comparable to those provided by Russell and Standard & Poor’s, respectively.

All Buy|Add|Hold|Trim|Sell decisions, Target Prices and Weightings in the Portfolio are based on the independent analysis & judgment of the focused 1–3-person Portfolio Manager / Analyst Team through the disciplined repeatable process with 30+ year origins that has a high probability of attractive portfolio characteristics and consistent investment performance.

Vanguard Small Cap & Mid Cap CRSP Equity Index ETFs

2013 – Vanguard changed the Index Provider to their Small, Mid, Large & Total US Market ETFs to CRSP Equity Indexes

CRSP – Center for Research in Stock Prices founded in 1960 is an affiliate of the University of Chicago’s Booth School of Business and provides CRSP Market Indexes.

The CRSP US Equity Index methodology is considered to be the strongest among other prominent index providers by sophisticated investors, academics, and others. Vanguard adopting these indexes in 2013 along with very low expense ratios has brought tremendous growth in AUM and trading volume to these ETFs. The 6 Vanguard Small Cap & Mid Cap CRSP Equity Index ETFs (VB, VBR, VBK, VO, VOE, VOT,) are ideal for ABCS’s Strategy covering the bottom 30% of the US market with nearly no overlap between Small & Mid. The Small Cap CRSP Equity Index covers the 98th to 85th percentile and the Mid Cap CRSP Equity Index covers the 85th to 70th percentile of the total US market by market cap weighting.

The Vanguard Small Cap & Mid Cap CRSP Equity Index ETF tickers, # of stocks, fees and AUM are provided below:

| # of Stocks | Fees | AUM ($Billion) | |

| Small Cap ETFs | |||

| VB (Blend) | 1322 | .05% | 162.4 |

| VBR (Value) | 842 | .07% | 59.1 |

| VBK (Growth) | 571 | .07% | 39.1 |

| Mid Cap ETFs | |||

| VO (Blend) | 290 | .04% | 201.3 |

| VOE (Value) | 180 | .07% | 32.4 |

| VOT (Growth) | 121 | .07% | 33.1 |

As of 09/30/2025

Evolution of ABCS ETF & US Equity Market ETFs

The evolution of ABCS was a result of 4 separate but related paths over time:

- The active equity Philosophy, Process & Strategy that began with the development of the Dynamic Equity Fund by a former Partner/colleague in the 1980’s. The Small-Mid Cap strategies developed & managed at Boston Partners beginning in 1995 – validating advantages of a broader Small-Mid Cap mandate. And the development of the Alpha Blue Alternative Equity Strategy beginning in 2010 – that formerly added Quality (V,F,Q,M) and began investing in Vanguard CRSP Equity Index ETFs.

- The Fama-French published research work in 1992 & 2015 on Value, Size & Quality.

- Alpha Architect’s founding in 2010 & ultimately transitioning to also provide an ETF white label service through its EA Series Trust (ETF Architect) beginning in 2014.

- The evolution of ETFs that began with Vanguard offering an S&P 500 Index mutual fund in 1976, then the first ETF offered in SPY in 1993 also tracking the S&P 500 Index. In 2013 Vanguard transitioning its primary Small & Mid Cap ETFs to track CRSP Equity Indexes and becoming part of ABCS’s investment strategy.

The more complete timeline culminating in ABCS-Alpha Blue Capital US Small-Mid Cap Dynamic ETF being launched in 2023 is as follows:

1960 – Center for Research in Security Prices (CRSP) established by University of Chicago Professors through a grant funded by Merrill Lynch.

1975-1976 – Vanguard founded & launched the first S&P 500 Index Mutual Fund.

1980’s-1995 – Dynamic Equity Fund (DEF) developed for Institutional Investors at The Boston Company Asset Management. As well as an affiliated Equity Hedge Fund with bottom-up security selection: Value, Fundamentals, Momentum (V,F,M).

1992 – Fama French’s 3-Factor Model research work published (University of Chicago) – The Small Cap Factor and Value Factor added to the Market Risk Factor outperforms the Market.

1992 – Vanguard launched Total US Market Mutual Fund – 2013 transitioned to CRSP Index4.

1993 – First ever ETF launched (by State Street Global Advisors) S&P 500 Index ETF – SPY.

1995-2022 – Premium Equity, Small & Small-Mid Value Strategies for Institutions at Boston Partners upon Founding.

1998-2022 – Small-Micro Cap Value Mutual Fund (Investor/Institutional Share Classes) launched at Boston Partners.

2000 – iShares launched S&P 500 Index ETF – IVV.

2000-2001 – iShares launched Russell 2000 (IWM), Russell Mid (IWR), Russell 1000 (IWB) ETFs.

2001 – Vanguard launched Total US Market ETF – VTI – 2013 transitioned to CRSP Index.

2004 – iShares launched S&P Total US Market Index ETF – ITOT.

2010 – Vanguard launched S&P 500 Index ETF – VOO

2010-2022 Alpha Blue Capital L.P. | Alpha Blue Alternative Equity Hedge Fund founded while at Boston Partners: Bottom-up Security Selection – Value, Fundamentals, Quality & Momentum (V,F,Q,M).

2010 – Center for Research in Security Prices (CRSP), an affiliate of the University of Chicago’s Booth School of Business launches newly developed CRSP Equity Indexes – including Value & Growth Indexes.

2012 -2013 – Vanguard Small Cap ETFs (VB, VBR, VBK) & Mid Cap ETFs (VO, VOE, VOT) transitioned to CRSP Equity Index ETFs.

2014 – ETF Architect launches its first ETF on its EA Series Trust ETF platform.

2015 – Fama French 3-Factor research work in 1992 extended to a 5-Factor Model adding Quality Factors. Others followed that the Momentum Factor be considered as well.

2021 – Alpha Blue Alternative Equity Strategy begins investing in Vanguard CRSP Equity Index ETFs.

2022 – Alpha Blue Capital L.P. | Alpha Blue Alternative Equity Strategy spun out to Alpha Blue, LLC.

2023 – ABCS-Alpha Blue Capital US Small-Mid Cap Dynamic ETF launched by Alpha Blue, LLC. Bottom-up security selection: Value, Fundamentals, Quality, Momentum (V,F,Q,M) with the flexibility to integrate Vanguard Small & Mid Cap CRSP Equity Index ETFs.

Who we are

The Alpha Blue Family Office entities are led by David M. Dabora, CFA. He has over 30 years of investment experience and is the Founder. Managing Partner & Portfolio Manager of Alpha Blue, LLC | Alpha Blue Capital L.P. | Alpha Blue Capital Management LP providing Fundamental Research & Value-Focused Investment Management, since inception in 2010. Located in the San Francisco Bay Area City of Greenbrae in Marin County, California. He is the portfolio manager & architect of the ABCS-Alpha Blue Capital US Small-Mid Cap Dynamic ETF Strategy and the Alpha Blue Alternative Equity Strategy.

He was a Founding Partner of Boston Partners Asset Management LP in 1995. In September, 2022 he retired as Senior Portfolio Manager|Managing Director from what is now a different wholly owned company by Orix of Japan. After leading & growing 3 different small|small-mid cap strategies & the Alpha Blue Alternative Equity strategy to $6+ billion AUM with strong investment performance over 27+ years.

He was the Senior Portfolio Manager and architect of the Small Cap Value II Mutual Fund since inception in 1998.

He also served on the Executive Committee from 2012 until leaving the firm in 2022 to focus on the management of Alpha Blue, LLC | Alpha Blue Capital L.P. and to launch and fund both Alpha Blue Capital Management LP & Alpha Blue Capital US Small-Mid Cap Dynamic ETF – ABCS.

Mr Dabora holds the Chartered Financial Analyst (CFA) designation since 1996, is a graduate of UCLA Anderson School of Management – MBA, Finance 1992 and Penn State University – BS, Business Administration 1986. He also holds the FINRA Series 65, Investment Advisor Representative (IAR) credential since 1995.

Joshua B. Dabora is a Partner & Investment Associate of Alpha Blue, LLC | Alpha Blue Capital L.P. | Alpha Blue Capital Management LP. Mr. Dabora is a graduate of Santa Clara University Leavy School of Business – MS, Marketing 2024 and Santa Clara University – BA, Communication 2023. He also holds the FINRA Series 65, Investment Adviser Representative (IAR) credential since 2025.

ETF Architect Partnership & Leadership

EA Advisers, based in the Philadelphia area is the adviser for ABCS on their industry leading-value white label ETF platform EA Series Trust (ETF Architect). EA Advisers is also providing quantitative consulting and monthly portfolio characteristics analysis to streamline ABCS’s Active Equity Investment Process and its “4-Levels” of bottom-up stock selection based on Valuation, Fundamentals & Quality, Business Momentum & Catalysts and establishing Target Prices.

Wesley Gray (University of Chicago, PhD Finance)

Jack Vogel (Drexel University, PhD Finance)

David Dabora

Alpha Blue Capital